We Finance All Types Of Vehicles

And Equipment

Office & Print

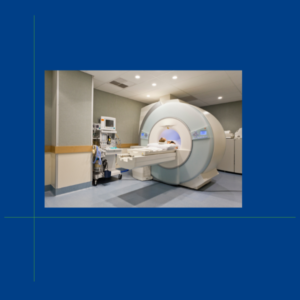

- MRI Scanners

- Medical Scopes

- Dental Chairs

- Dental X-Ray Machines

- Dental Drills Office & Print

We Are Here For You

When You Need

- Instant quote

- Fast digital application

- Dedicated support team

- Excellent Customer service

Read Our Deal Samples

Finance of a truck with hookloader

Term: 60 months

Cost Value: €141,700

Loan Amount: €120,000

This existing customer wished to purchase a specialist vehicle after winning a large contract within his area of expertise. Capitalflow were delighted to be able to facilitate this huge opportunity for this customer.

Finance of Cash Payment System

Term: 60 months

Cost Value: €27,430

Loan Amount: €24,700

A core investment in this business is a state of the art closed cash management system. The security of this cash solution gives this busy retailer assurance to operate safely.

Finance of a Double Decker Bus

A quirky little finance deal! An existing customer saw an opportunity in purchasing and restoring a retired double decker bus. The business out of this was aimed at private rental such as hire for concerts and secondary school debs events.

Finance of a CT Scanner

Term: 59 months

Cost Value: €275,000

Loan Amount: €275,000

100% finance was provided to purchase a CT scanner for a private hospital to be used by 14 consultant radiologists.

Finance of Dental Oral Drilling Equipment

Term: 36 months

Cost Value: €11,300

Loan Amount: €11,300

This long standing dental surgeon was looking to grow his practice by investing in the latest dental technology. A speedy process from application to payout was required and delivered by Capitalflow.

Finance of a Metrology Machine

Term: 60 months

Cost Value: €52,570

Loan Amount: €47,300

This piece of equipment was financed by Capitalflow for the manufacturing industry. This customer designs and manufactures battery packs for the agriculture and construction sectors.

Finance of a Mobile Crane

Term: 32 months

Cost Value: €335,000

Loan Amount: €260,000

An upgraded piece of machinery allowed this existing customer to expand their workload. Seeking finance at short notice, Capitalflow stepped in to offer the required funds.

Finance of A/V Equipment

Term: 60 months

Cost Value: €224,000

Loan Amount: €201,700

Finance was provided by Capitalflow to allow the purchase of new recording and sound equipment to this new customer.

Re-Finance Of Compact Tractor

Term: 60 months

Cost Value: €75K incl 10% deposit

Loan Amount: €67,500

Asset Finance Loan – North East Region

Deal value €175k

The transaction involved the leasing of a 2018 Excavator, the first one of its kind registered in Ireland in 2018. 90% of the funding supplied over 5 years, enabling the customer to maximise trading performance and increase market share.

Equipment Leasing – Midlands

Asset value €185k+VAT

Finance amount €160k+VAT

Client was purchasing an agricultural machine. The cost of the item new meant that the repayments over the standard 60 month term offered by their bank were prohibitive. That lender was slow in giving approval for a longer term. Capitalflow stepped in and gave approval for an 84 month term. Deal was completed within 2 […]

Showroom Refinance – Leinster

Asset value €140k+VAT

Finance amount: €100k, 36 month term on Hire Purchase

Client was expanding as completely re-fitted out two showrooms. The spend on equipment and fittings was €140k+VAT, which the client bought and paid for over the previous month from cashflow. Upon completion Capitalflow re-financed 70% of the cost over a 36 month term. This effectively refunded €100k back to client, with a very manageable monthly […]

Asset Finance Equipment Leasing – East Region

Finance amount: €120k

The Customer, a leading hotelier, required finance for a number of soft assets including new security system and computerised till machine. Capitalflow provided a payment term over 36 months, as that suited the business needs, with a fast turnaround, LTV 90%.

Asset Finance Equipment Leasing – Dublin Region

Finance amount: €800k

The Customer, a well-known publican, required finance for a number of soft assets including premises fit-out and CCTV. Capitalflow was able to step in and provide a quick funding solution in order to facilitate the purchase in the desired time frame.

Asset Finance & Property Term Loan – Dublin Region

Term: 20 years

Deal Value: €4m

Loan Amount: €3m

Asset Finance Amount: €350k

A cross sell opportunity arose during an Asset Finance visit with an existing customer enabling them to buy back their property from an International fund. Capitalflow could fund the Trading company directly supported by the business’s underlying profitability. Loan was amortised over 20 years and this was further helped by an increased Asset Finance line to […]

Frequently Asked Questions

Absolutely, every business is different with varying finance requirements.

We love working with Brokers and Intermediaries, and are always looking to increase our panel – contact us to find out more.

Every deal is different and will be reviewed on it’s own merits, big or small.

We have been supporting new and small businesses since 2016, contact us and let’s see what we can do.

We work with all businesses from sole traders to partnerships to Limited Companies. Whether you are a micro enterprise, a small or medium enterprise or a large Corporate we’ll be delighted to speak with you.

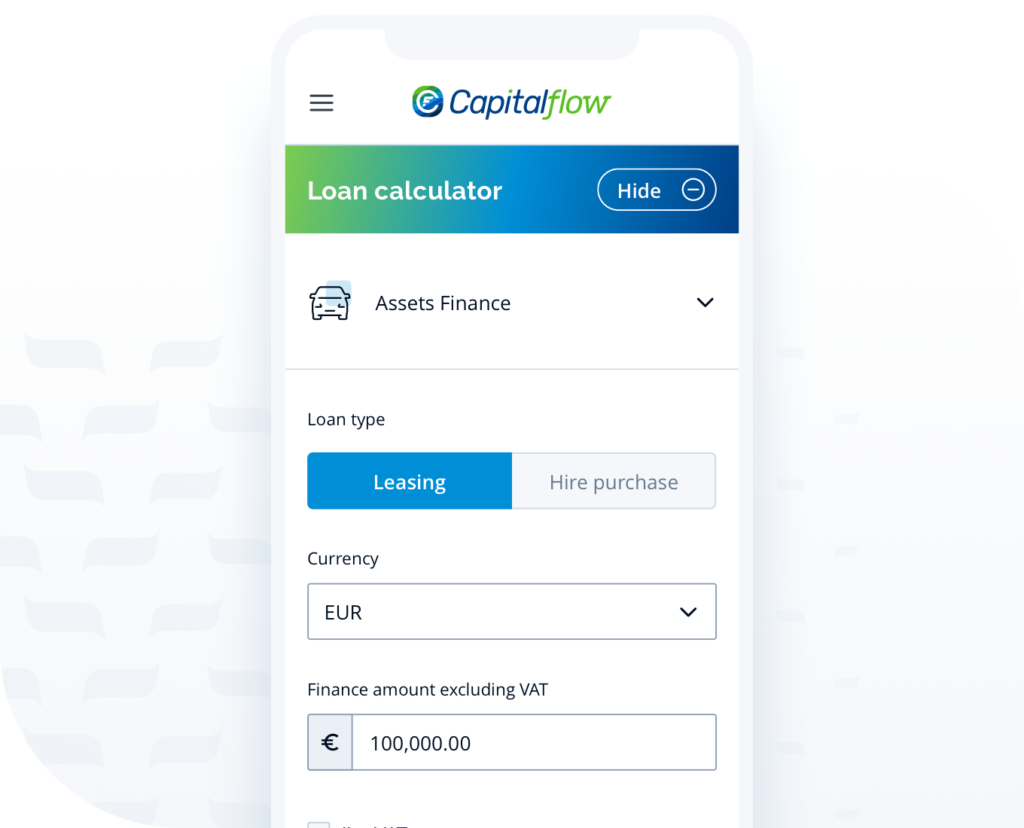

Hire purchase –with this product you’ll repay in installments via simple payment plan tailored to suit your budget and cashflow. At the end of the agreed repayment term, ownership passes to you for a nominal sum.

Finance leasing – a finance lease works as a rental agreement. We buy the asset you need and rent it to you over the duration of the lease contract. That means you have it straight away, and only need a fraction of the total amount up front.

Refinance – this is a finance solution that enables you to raise capital for your business by securing a loan against assets you already own, like machinery, equipment and vehicles

Rather than use up all your cash flow, Asset Finance allows you to pay for the asset over an agreed repayment term.